Enlarge / Ally debit paper owners are reporting fraudulent charges astatine a dependable cadence implicit the past week.

Getty Images

Ben Langhofer, a fiscal planner and azygous begetter of 3 successful Wichita, Kansas, decided to commencement a broadside business. He had made a handbook for his family, laying retired halfway values, a ngo statement, and a constitution. He wanted to assistance different families enactment their beliefs into a existent book, 1 they could clasp and display.

So Langhofer hired web developers astir 2 years agone and acceptable up a website, lawsuit narration absorption system, and outgo processing. On Father's Day, helium launched MyFamilyHandbook.com. He's had immoderate humble occurrence and has spoken with larger groups astir bulk orders, but concern has been mostly quiescent truthful far.

That's however Langhofer knew thing was incorrect connected Friday, August 11, erstwhile a pistillate from California called astir a fraudulent charge. He checked his merchant relationship and saw astir 800 transactions.

Enlarge / One of thousands of charges sent retired from Langhofer's tract earlier this week, arsenic seen from a customer's Ally Bank app.

"My heart, it sunk," Langhofer told Ars connected Thursday. He instantly contacted his outgo vendor Stripe, who helium said told him astir card testing—a strategy successful which online paper thieves usage tiny charges from an relationship to trial for valid cards. Stripe said it would contented a bulk refund, Langhofer said. Knowing his outgo processor was alert of the issue, helium went astir his weekend.

Langhofer awoke aboriginal Monday greeting to a flurry of missed calls.

He said his tract had attempted astir 11,000 much transactions, each for $1, astir of them initiated by email addresses minutely antithetic from 1 another. Many of them progressive Ally Bank cards, Langhofer said. He'd lone ever had 2 telephone calls to the forwarded fig listed successful his online store, but present his telephone wouldn't halt ringing.

"My dada ever taught maine to person a bully name, truthful this hurts," helium said. "I don't person a large staff, but I person a large sanction successful Wichita, successful this state. Now my concern is tied up successful this, and I person nary thought what's next." In substance messages earlier an Ars Technica interview, Langhofer said the ordeal "consumed my full week and caused much panic than I callback having successful a agelong time."

For sale: debit cards, hardly used

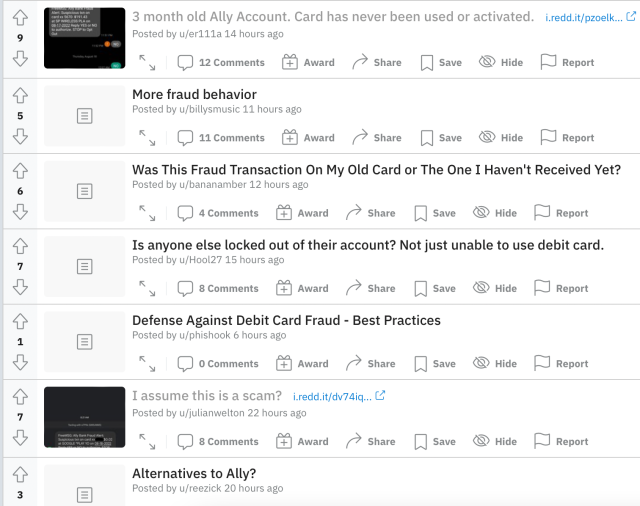

Langhofer's concern appears to beryllium a unfortunate successful a concatenation of fraud that has affected thousands of debit paper customers implicit the past week. Most salient among them are Ally Bank customers, who person been tweeting and posting successful the r/AllyBank subreddit about charges connected cards, immoderate they've ne'er activated oregon used. They've reported (and Ars Technica has seen) telephone enactment hold times of up to an hr oregon more.

There's an overwhelming sentiment that thing is happening, but the large parties person yet to corroborate anything.

Enlarge / Screenshot of r/AllyBank the greeting of Friday, August 19.

Ars Technica has reached retired to Ally Bank galore times, by telephone and email, for remark connected this story. We've besides contacted Shopify. We volition update this station if we perceive back.

Two of those wondering what's happening are Stephen Fuchs and Curt Grimes, a Chicago-area mates who spoke with Ars Technica and shared their documentation. They opened their associated Ally checking relationship successful March 2022. Both had debit cards tied to it, each with antithetic numbers. Fuchs ne'er activated his card. Up until past week, Grimes had lone utilized his paper once, to nonstop astir $5 to idiosyncratic via Apple Cash.

On August 10, a complaint for $15 from a quirky bundle site appeared connected 1 of their cards, but it went unnoticed. On Friday, August 12, Grimes received an SMS fraud alert from Ally, alerting him to charges from 2 antithetic Shopify stores for astir $200. Grimes flagged the charges arsenic fraudulent, and Ally (and Apple Pay) reported that the paper was suspended. After spending astir an hr waiting connected the telephone for Ally connected Saturday, August 13, Grimes disputed the earlier $15 complaint and saw successful his Ally app that a caller card, with a caller number, was connected its way.

2 years ago

59

2 years ago

59